The Essential Guide to Forex Trading Programs

In the fast-paced world of finance, having the right tools can make all the difference. Forex trading programs are essential for traders who want to maximize their potential in this vibrant market. These programs not only offer trading signals and analytical tools but also enhance the overall trading experience. They allow traders to automate certain tasks, analyze market trends, and execute trades efficiently. Explore the best features these programs can offer by checking our recommendations for forex trading programs Best MT4 Platforms.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currency pairs in the global market. It is one of the largest financial markets, with trillions of dollars exchanged daily. Unlike stock markets, the forex market operates 24 hours a day, enabling traders to trade at any time. Knowledge of global economic factors, geopolitical events, and market sentiment is critical for success in forex trading.

The Role of Forex Trading Programs

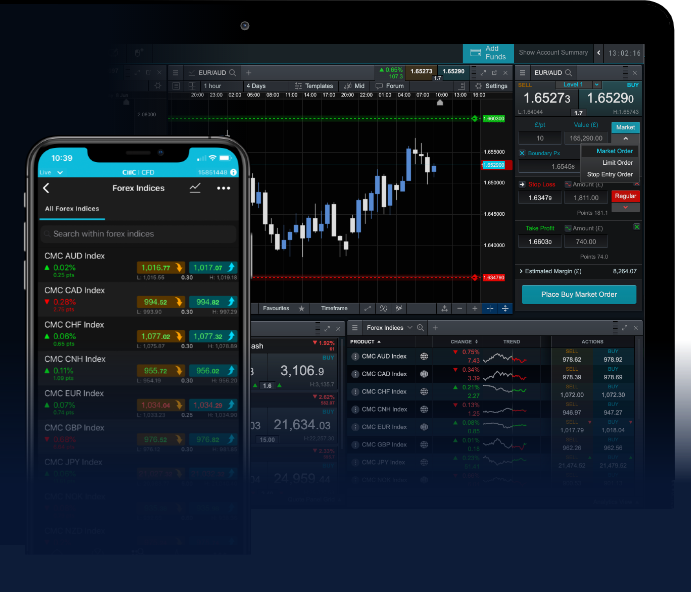

Forex trading programs, also known as trading software or platforms, are designed to facilitate the trading process. They provide a user-friendly interface for executing trades and accessing analytical tools. Here are some of the key roles that forex trading programs fulfill:

1. Trade Execution

Forex trading programs enable users to buy and sell currency pairs with just a few clicks. They ensure that trades are executed swiftly and at the desired price. Speed is crucial in forex trading, where price fluctuations can occur in milliseconds.

2. Charting and Analysis

Most trading platforms come equipped with charting tools that display currency price movements over time. Traders use these charts to identify trends, patterns, and potential entry and exit points. Advanced analytical tools can also apply various indicators and overlays to enhance decision-making.

3. Automated Trading

One of the most significant advantages of using forex trading programs is the automation of trades through algorithms. Traders can set specific parameters and strategies, allowing the program to execute trades on their behalf without manual intervention. This feature is especially beneficial for those who cannot constantly monitor the market.

4. Risk Management

Forex trading programs also provide tools for effective risk management. Traders can set stop-loss orders, take-profit levels, and other protective measures to safeguard their investments. This encourages disciplined trading and helps manage emotions, reducing the likelihood of impulsive decisions.

Choosing the Right Forex Trading Program

With countless forex trading programs available, selecting the right one can be daunting. Here are some factors to consider when choosing a program:

1. User Experience

The user interface should be intuitive and easy to navigate. A straightforward design will allow you to focus on trading rather than struggling with the software.

2. Features and Tools

Examine the features offered by the trading program. Are there advanced charting tools? Can you automate your trades? Look for a program that meets your specific trading needs.

3. Reliability and Speed

The efficiency of trade execution can significantly impact your trading results. Select a trading program known for its reliability and speed to ensure timely order execution.

4. Customer Support

Good customer support is vital. If you encounter any issues with the program, having a responsive support team can save you time and frustration.

Popular Forex Trading Programs

Here are some popular forex trading programs that cater to different types of traders:

1. MetaTrader 4 (MT4)

MetaTrader 4 is one of the most widely used forex trading platforms. It offers a range of features, including advanced charting tools, automated trading through Expert Advisors, and a user-friendly interface. MT4 is especially popular among retail traders.

2. MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4, providing traders with additional functionality. The platform offers more timeframes, additional technical indicators, and the ability to trade in multiple markets, including stocks and commodities.

3. cTrader

cTrader is known for its intuitive interface and speed of execution. It focuses on catering to the needs of advanced traders and offers comprehensive features, including algorithmic trading and advanced charting tools.

4. TradingView

TradingView is a web-based platform that allows traders to analyze markets and share trading ideas. While it does not facilitate trades directly, it integrates with various brokers, enabling users to execute trades from within the platform.

Conclusion

Forex trading programs are essential tools for both novice and experienced traders. They provide the necessary features to enhance trading effectiveness, manage risks, and automate processes, making trading more efficient. By carefully considering your trading style, needs, and preferences, you can select a forex trading program that aligns with your goals. Remember to stay informed, continuously learn, and adapt your strategies as the market evolves.