Forex vs Stocks: Which is the Better Trading Option?

When considering trading, one of the first decisions you have to make is whether to enter the forex market or the stock market. Both offer unique advantages and challenges, and understanding these can help you determine which might be the best fit for your trading style. In this article, we will delve into the nuances of trading forex vs stocks, examining their characteristics, benefits, risks, and strategies. Moreover, for those looking to dive deeper and stay updated with trading insights, trading forex vs stocks Trading PH is a valuable resource in the trading community.

Understanding Forex and Stock Markets

The forex market, or foreign exchange market, is a global decentralized marketplace for trading national currencies against one another. It’s the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. On the other hand, the stock market consists of exchanges where shares of publicly traded companies are bought and sold. The stock market is influenced by numerous factors including company performance, investor sentiment, and economic indicators.

Market Hours

The forex market operates 24 hours a day, five days a week, allowing traders from all around the world a chance to participate at almost any time. The stock market is typically open for trading during specific hours based on the country in which the exchange is located. For instance, the New York Stock Exchange operates from 9:30 AM to 4 PM EST. This difference in market hours can impact trading strategies, with forex providing more flexibility for those trading around their personal schedules.

Liquidity and Volatility

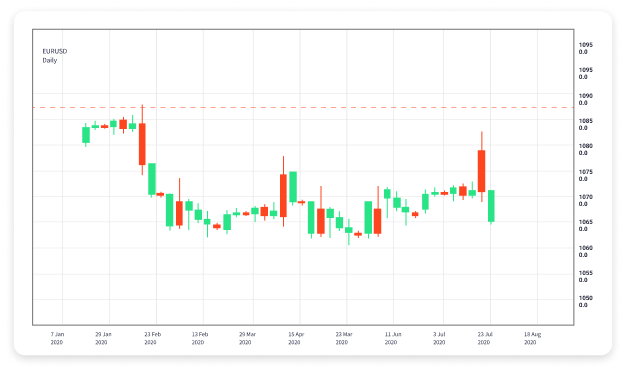

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. The forex market’s sheer size contributes to its high liquidity. Major currency pairs like EUR/USD or USD/JPY can be traded in substantial amounts without causing price slippage. In contrast, stocks may display varying levels of liquidity; blue-chip stocks tend to have high liquidity, while penny stocks can be more susceptible to volatility.

Volatility is another crucial factor to consider. Stock prices can sometimes be more stable, particularly for established companies. However, stocks can also fluctuate dramatically based on news and earnings reports. Conversely, the forex market is known for its volatility, driven by geopolitical events, interest rate changes, and economic data releases, creating both opportunities and risks for traders.

Leverage

Leverage allows traders to control a larger position than they would typically be able to with their own capital. In the forex market, leverage is often higher, sometimes exceeding 100:1. This means that for every dollar in your trading account, you can trade a position worth $100. While this can amplify profits, it also increases the risk of losses. In contrast, stocks typically offer lower leverage, often around 2:1 or 4:1, which can lead to more conservative risk management compared to forex trading.

Trading Strategies

Both forex and stock trading can employ various strategies, but they differ in their execution and focus. Forex traders might utilize strategies like scalping (short-term trades), day trading, or swing trading, focusing on currency pairs and technical indicators. Stock traders often look at fundamentals, employing strategies like value investing, growth investing, or momentum trading, analyzing company performance, market conditions, and economic indicators.

Costs and Fees

When trading forex, costs typically come in the form of spreads—the difference between the bid and ask price. Forex brokers usually charge lower spreads than stock brokers charge in commissions. In the stock market, commission structures can vary significantly among brokers, especially with the rise of commission-free trading platforms. However, trading stocks can sometimes involve additional fees, such as those associated with short selling or specific exchange fees.

Which is the Right Market for You?

Deciding whether forex or stock trading is the right choice involves a self-assessment of your trading style, financial goals, and risk tolerance. If you prefer a more fast-paced and flexible trading environment with significant leverage, the forex market may appeal to you. Conversely, if you are interested in company fundamentals and investing for the long term, the stock market might be a better fit.

Conclusion

Both forex and stock trading present unique opportunities and challenges. By carefully considering the factors outlined in this article—market hours, liquidity, volatility, leverage, and your personal trading strategies—you can make a more informed decision about which market aligns with your investment goals. Whether you choose to trade currencies or stocks, knowledge, practice, and understanding market dynamics are key to achieving trading success.