How to Successfully Open a Forex Trading Account

Entering the world of forex trading can be both exciting and daunting for new traders. It’s essential to open a forex trading account with the right broker to make your trading experience smooth and successful. In this article, we will guide you through the steps required to open a forex trading account, what you need to know before taking the plunge, and some valuable tips for beginners. For your trading journey, consider exploring forex trading account opening Thai Trading Platforms that may cater to your specific needs.

Understanding Forex Trading Accounts

Forex trading accounts are financial accounts where traders can buy and sell currencies. There are different types of accounts available, including demo accounts, retail accounts, and professional accounts. A demo account is a valuable tool for beginners as it allows you to practice trading without risking real money. In contrast, retail accounts are intended for individual traders, while professional accounts may come with additional benefits and higher leverage for experienced traders.

Steps to Open a Forex Trading Account

Step 1: Research Forex Brokers

The first step in opening a forex trading account is to research various brokers. Look for a broker that is regulated, has a good reputation, and offers competitive spreads and trading conditions. It’s also important to check the platform’s features, customer service, and the variety of instruments they offer.

Step 2: Choose the Right Type of Account

Once you have selected a broker, review the types of accounts they offer. Many brokers provide multiple account types tailored to the needs of different traders. If you are a beginner, you might want to start with a standard account or a demo account. Advanced traders may prefer VIP or professional accounts due to additional features and benefits.

Step 3: Complete the Application Form

After selecting the type of account, the next step is to fill out the application form. This form typically requires personal information, including your name, address, date of birth, and contact details. Ensure that you provide accurate information, as discrepancies can delay the account opening process.

Step 4: Provide Verification Documents

To comply with regulatory requirements, brokers will ask for verification documents. Common documents include a government-issued photo ID (passport or driver’s license) and proof of address (utility bill or bank statement). Some brokers might also require additional documents depending on their policies.

Step 5: Fund Your Account

Once your account application is approved, you’ll need to fund your trading account. Brokers often offer multiple funding options, such as credit/debit cards, bank transfers, and e-wallets. Check the funding options and any associated fees before making a deposit.

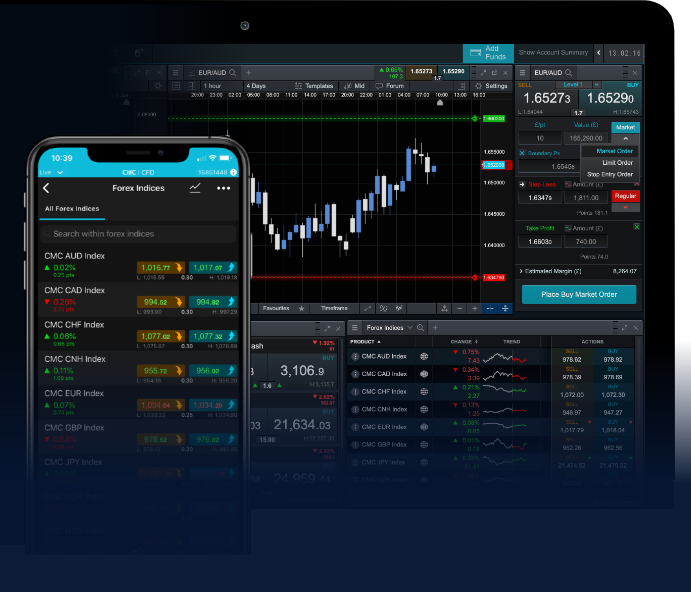

Step 6: Download the Trading Platform

After funding your account, the next step is to download the trading platform. Most brokers provide access to popular platforms like MetaTrader 4 or 5, which are available for desktop and mobile devices. Familiarize yourself with the interface, tools, and features before engaging in live trading.

Step 7: Start Trading

With your account funded and the trading platform set up, you’re ready to start trading. Begin with small trades to get accustomed to the market dynamics and the trading conditions provided by your broker.

Common Requirements for Forex Account Opening

While the specific requirements may vary depending on the broker, some common elements are generally required to open a forex trading account:

- Age: Most brokers require you to be at least 18 years old.

- Identification: A valid government-issued ID is needed.

- Proof of Residence: A utility bill or bank statement will suffice.

- Contact Information: A valid email address and phone number.

Tips for Choosing the Right Broker

Finding the right broker can significantly influence your trading success. Here are some tips to consider:

- Regulation: Ensure that the broker is regulated by a reputable authority to enhance your security.

- Trading Costs: Compare spreads, commissions, and overnight fees to find the most cost-effective broker.

- Trading Platform: Choose a broker that offers a user-friendly and reliable trading platform.

- Customer Support: Assess the level of customer support provided, including availability and communication channels.

Conclusion

Opening a forex trading account is the first step in your trading journey. By following the outlined steps and considering key factors such as regulation, account types, and fees, you can find a broker that meets your trading needs. Remember to start with a demo account if you’re a beginner, and always trade responsibly. With time and practice, you can become a successful forex trader. Happy trading!